We Help Top Advisors Add $10M-$50M To Their AUM Annually

Without Seminars, Buying Leads, Or LinkedIn "Networking" - Get new advisory clients coming to you... 10-20+ high-value booked appointments guaranteed

Without Seminars, Buying Leads, Or LinkedIn "Networking" - Get new advisory clients coming to you... 10-20+ high-value booked appointments guaranteed

Results Focused, Compliance Vigilant

Apply concepts with confidence and your organization’s approval.

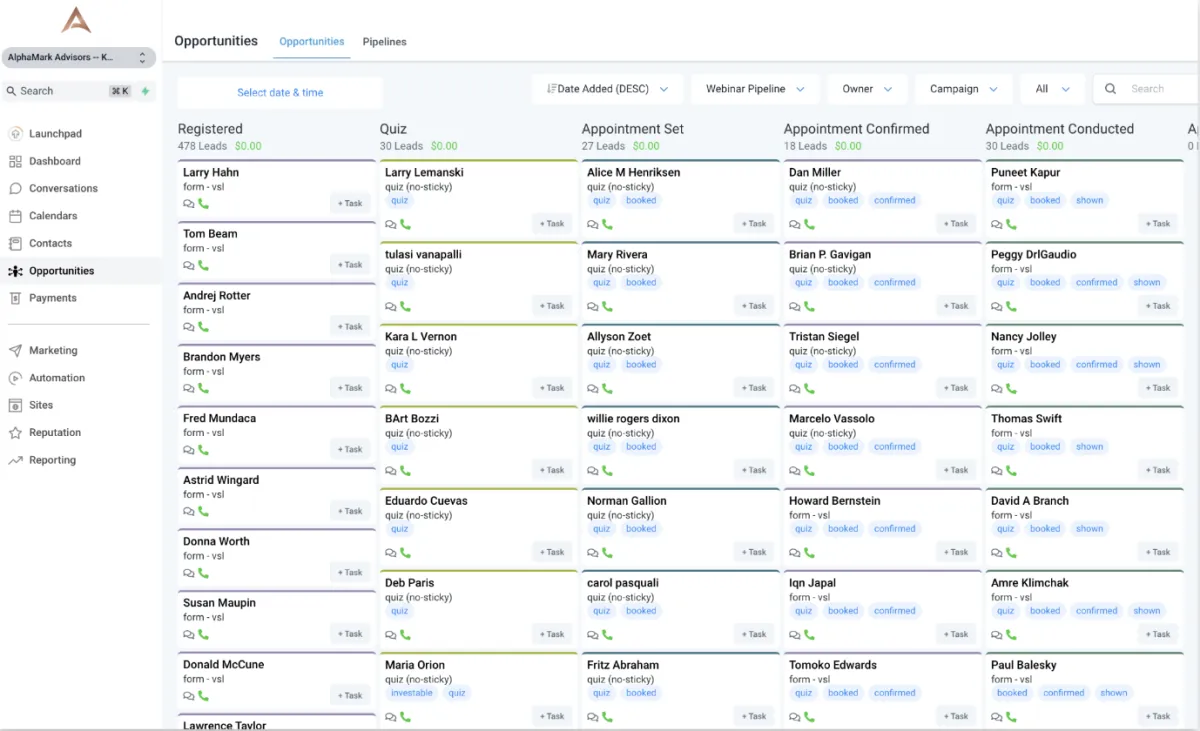

AlphaMark Advisors

Anthony Frambes Adds $23m in AUM In 8 Months.

Superstar advisor. Already at the top of his game, but needed a way to generate volume passively. Buddies with Patrick-bet-david, he knows how to win. Sales expert and 7-figure insurance producer. Naturally, he felt like he didn't need that much help. But we helped Jon realize that his successful business could one-day run without him having to generate volume - if he implemented the right systems in place. So he took the leap of faith and joined our Apex Ascension program.

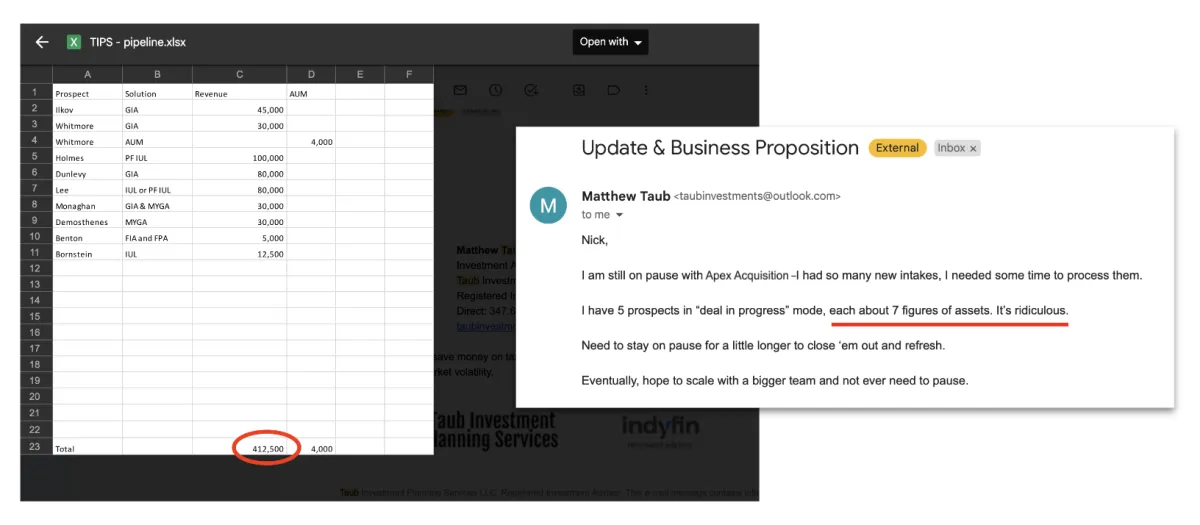

Taub Investment Planning Services

Matthew Taub Generated $412k In New Pipeline Revenue In Just 90-Days (& Learned The Skill Of Closing Virtually)

Matthew's story is inspiring for the entire team at Apex. He's a testament that success is always on tSub-Headlinehe other side of difficulty. If you'e willing to push through, you WILL reap the rewards.

When Matthew signed up with us, he thought things were going to be automatic. Yes, the appointments are automatic! When we turned Matthew's campaign on, he didn't have to lift a finger to start getting "absolutely flooded" with new appointments (his own words!).

But, he didn't anticipate that his sales process would have to be altered in order to close the highest percentage of these appointments. Run far and fast away from ANYONE that promises instant and easy business growth. Business is hard, and those that persevere will win. Nobody can grow your business for you.

But Apex served as a serious unfair advantage for Matthew.

John Mateyko

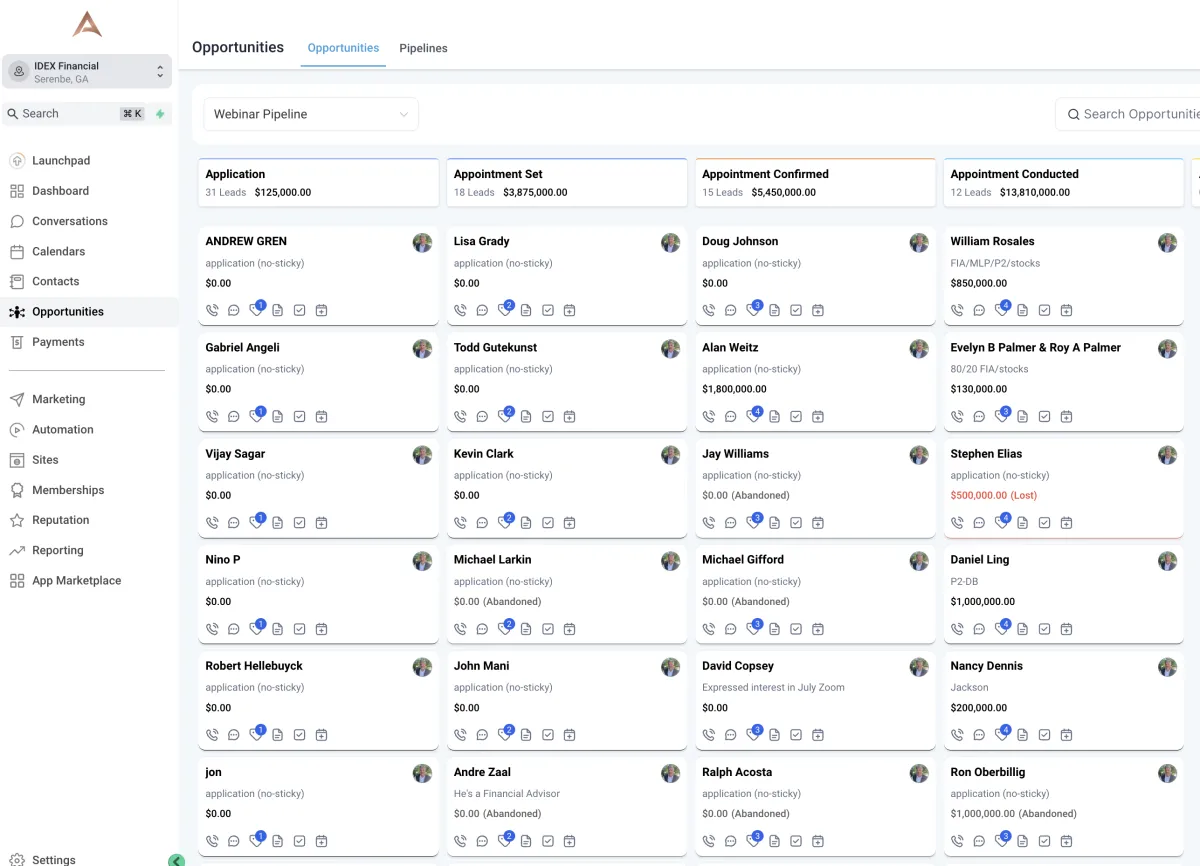

"I've had $9m in the pipeline in the last 2 weeks on a $1,200 ad spend, with second appointments booked in... Is this normal???"

Over $62m in pipeline value!

John Mateyko, APMA®, WMCP™, RICP® is an Augustana College alum - class of '98. He started at Dean Witter in 1999 in New York City. He has worked as a Financial Advisor for some of the country's largest banks, including Atlas Securities, US Bank, Chase, and Fifth Third Securities; where he won numerous awards for production and client acquisition.

Aaron Hawks

Aaron Hawks Secures .$2.8m In 90-Days. .In A Small Town. (Clive, Iowa)

Small town. Total addressable market size of 10,000 people. We knew something has to change. So we decided to push Aaron through a multi-state campaign. We expanded his audience to a few million ultra-qualified people, and used blue ocean content to capture and keep their attention.

It worked. Aaron is now the fastest growing advisor in his area, and is pacing $100M/YR in additional AUM. A massive feat, especially coming from humble beginnings in Iowa to the nationwide stage.

Jon Mason

Buddies with Patrick-bet-david, he knows how to win. Sales expert and 7-figure insurance producer. Naturally, he felt like he didn't need that much help. But we helped Jon realize that his successful business could one-day run without him having to generate volume - if he implemented the right systems in place. So he took the leap of faith and joined our Apex Ascension program.

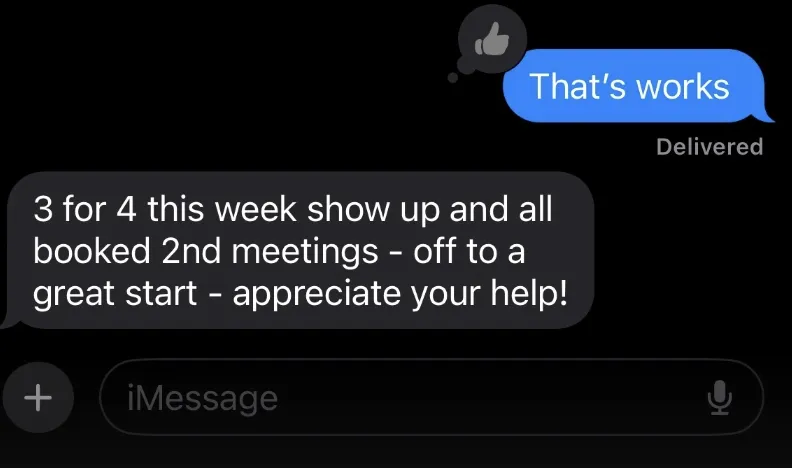

Some of our clients need intensive coaching. We're no stranger to it & it's one of our favorite things to do. But Jon was an easy deal for us. We simply plugged him into our system, and because of his proficiency with sales, he crushed it on week one.

TRANSFORMATION (#s)

FROM Darian

Keith Hazelwood

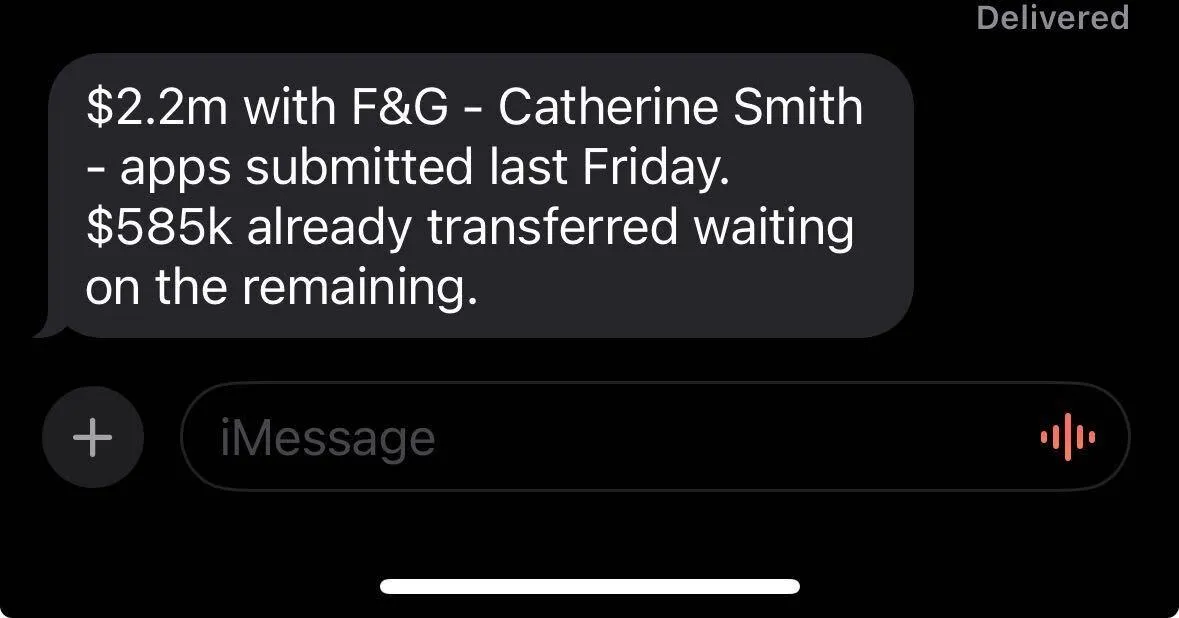

Keith Hazelwood Closes 80% Of His Apex Appointments Into Clients

Some advisors prefer less volume and would rather focus on higher net worth deals with less competition. Keith closed 3 deals in 2.5 months, each with over $1.5M in assets. Including a $2.2m annuity resulting in a $180k payday for Keith on just ONE of the deals.

Client Support Calls!

Melanie & Vincent

Adam Levy - 4x return

Founder of Momentum Wealth Advisors. Adam Levy came to us with a problem

Proske & Petzold - Coastal

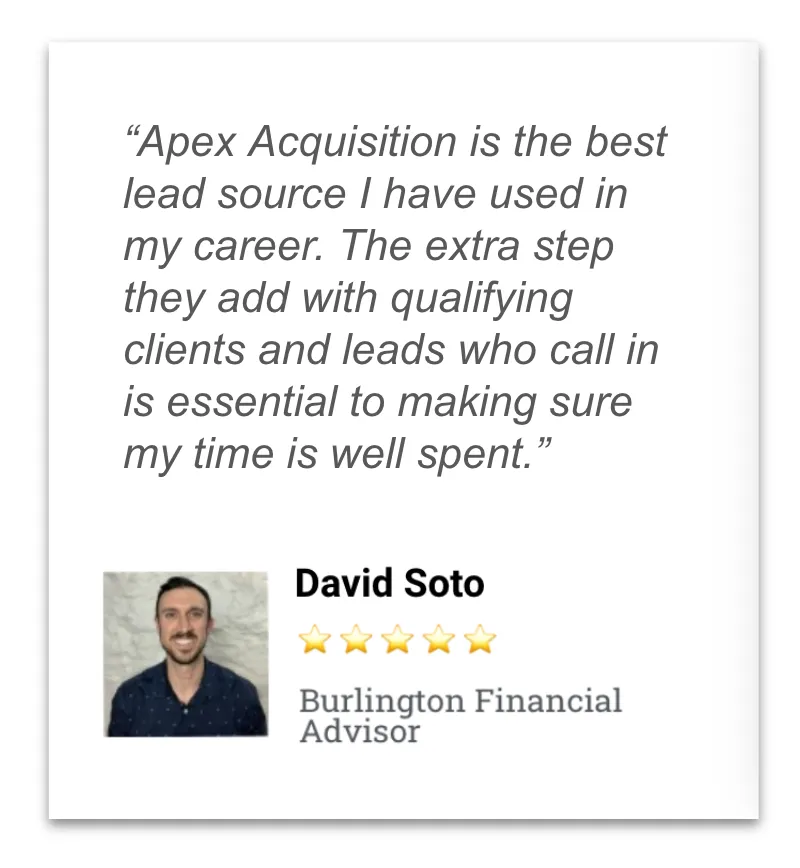

David Soto

David Soto Adds $4.1m To His AUM In 5 Weeks, With 34 Appointments, And 6 New Clients Closed. From Our Campaigns.

John Choi

Ngoc Le

Ngoc is a California based insurance expert. She came to us having had tried all kinds of marketing solutions. From buying leads, to running ads, to working with marketing companies. Once we coached her to making the jump, she was ready.

Alex Stohr

Ngoc is a California based insurance expert. She came to us having had tried all kinds of marketing solutions. From buying leads, to running ads, to working with marketing companies. Once we coached her to making the jump, she was ready.

Before

Alex Stoehr:

Used service (conversionly) that did not have experience ever working with financial advisors, left them in the dark, and had not success managers there answer any questions or concernsNeeded more lead flow and did not want to rely on just in-person walk-ins to the office => needed more at bats because was already SOLD on his own process to close businessDealt with programs that didn't know the definition of investable assets fully. Very frustrating when money is tied up and nothing to do about it

Jordan Breslow

Ngoc is a California based insurance expert. She came to us having had tried all kinds of marketing solutions. From buying leads, to running ads, to working with marketing companies. Once we coached her to making the jump, she was ready.

Michael Hamilton / Misty

Michael & Misty are top insurance producers in Arkansas. While they may have extensive experience in their industry, generating volume in a small population town had been close to impossible.

In fact, it was even a tall task for our system. We started by simply targeting those in Arkansas above a certain income threshold. Which did NOT work. We then realized that advertising platforms have less data from people in smaller cities / states.

We then decided to remove ALL targeting. Going fully broad, allowing the platform AI do the filtering for us. It immediately expanded our addressable market size and we started to...

FLOOD appointments on the calendar. It became so overwhelming, Michael asked to pause volume a couple times.

George G

32 appointments for George from Pinnacle Wealth In Ohio… Resulted in 7 new clients and $3.3m in new AUM added in just a month and a half.

Before Working With Us

After Working With Us

Relied primarily on referrals to grow his practice, resulting in rollercoaster-like inconsistent growth.

Exhausted his options of buying leads, seminars, LinkedIn, and direct mailers... with little to no success.

Struggling with 3-4 appointments per month, only adding $2.3M in AUM every 6 months.

Relied primarily on referrals to grow his practice, resulting in rollercoaster-like inconsistent growth.

Exhausted his options of buying leads, seminars, LinkedIn, and direct mailers... with little to no success.

Struggling with 3-4 appointments per month, only adding $2.3M in AUM every 6 months.

Reduced his time spent on marketing down to 1-2 hours a month.

Consistently taking 15 quality appointments per month (more than 3X his past volume)

On track to add $7.6M in new AUM within the first 6 months working with us.

Reduced his time spent on marketing down to 1-2 hours a month.

Consistently taking 15 quality appointments per month (more than 3X his past volume)

On track to add $7.6M in new AUM within the first 6 months working with us.

Alexis Chavez

11 appointments booked, 7 taken, and 3 new clients signed for Tandem Wealth Strategies In Ft Lauderdale… That’s $1.8M in added AUM in ONE WEEK!

Frequent Questions

Will this work with my compliance department?

Yes! This is a compliance friendly solution for all compliance departments. If you have stricter than normal compliance regulations, we will communicate directly with your compliance to make any amendments to your campaign before launch.

How does your pricing structure work?

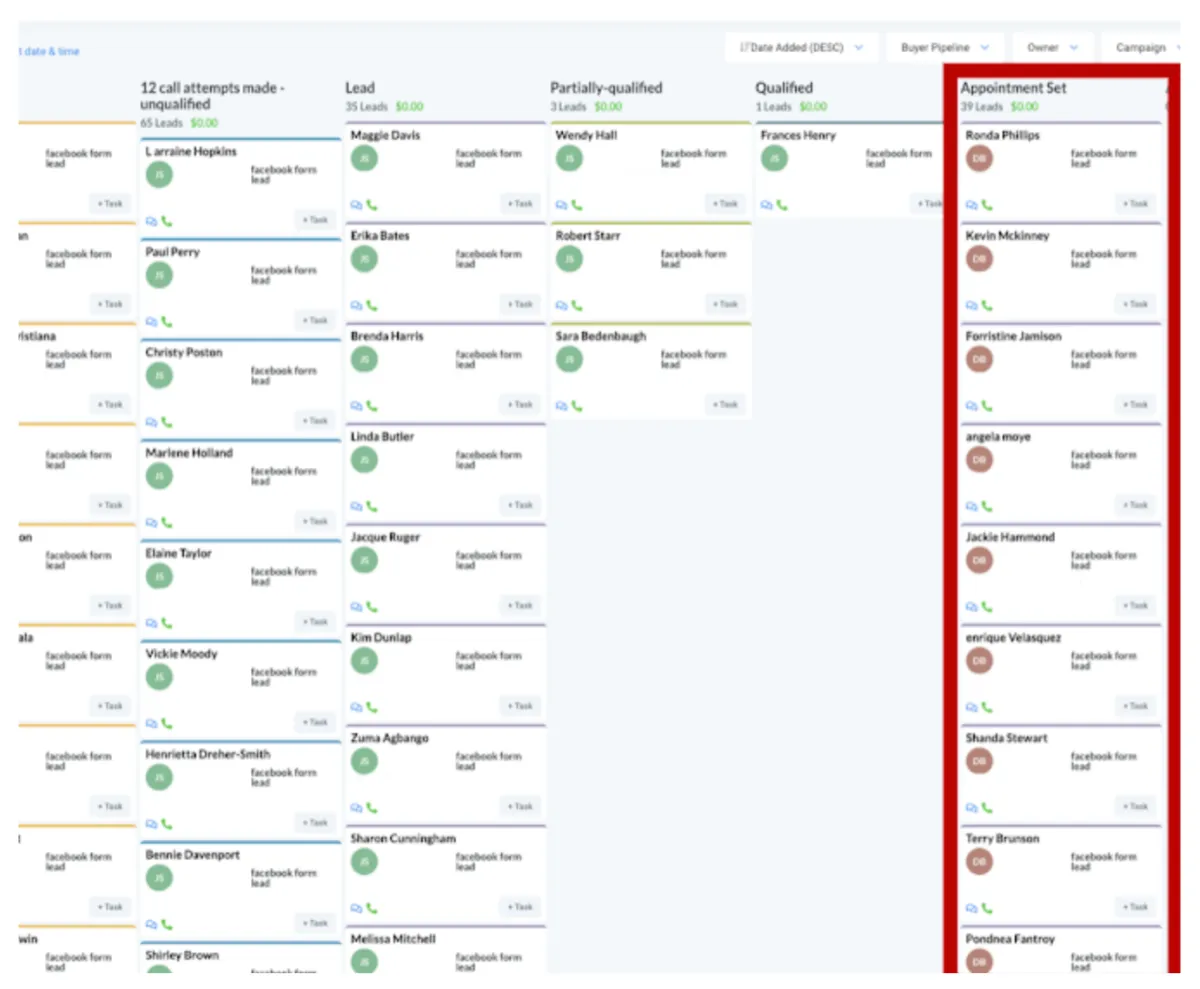

At Apex Acquisition, we do things differently. We don't do "pay per lead" or "pay per appointment" because that business model is fundamentally flawed. Companies that use this model get paid based on how many leads you buy, and not whether that lead actually shows up, is qualified or becomes a client - the incentives are off. Our goal isn't to flood you with leads but to only get you in front of the people that you want to be speaking with.

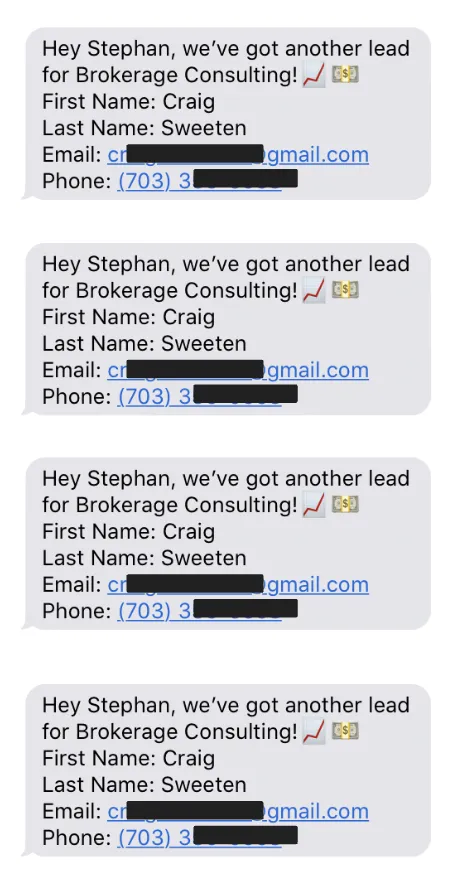

How long does it take to see appointments on my calendar?

Say goodbye to month-long setup times. We'll have your campaign ready within 7-10 days and within 24-72 hours of going live, you are likely to see your first appointment scheduled.

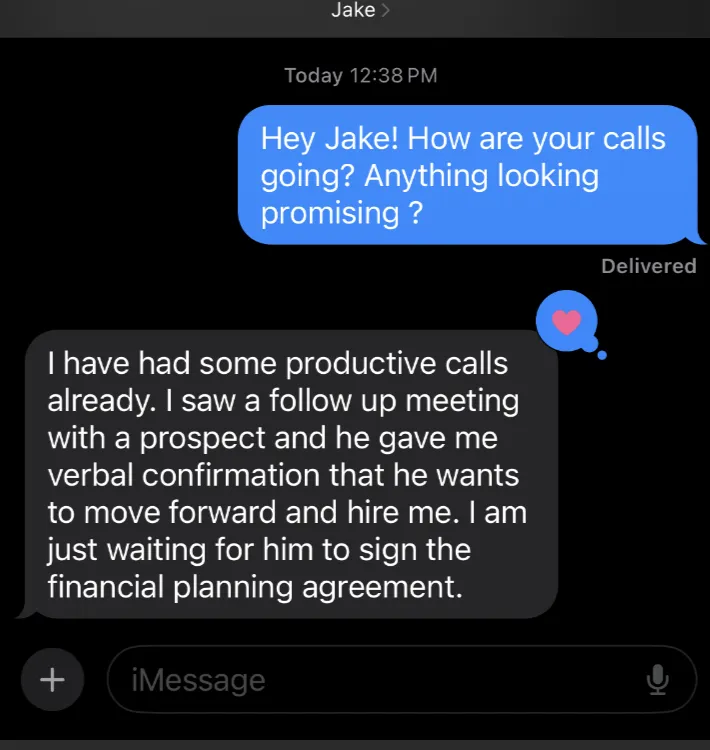

What type of show up rate and close rate can we expect?

On average we are seeing a 70% show up rate and 25-50% close rate off the appointments that you speak with. Appointments that don't show up, are not counted towards our guarantee.

Who do you serve?

We help financial advisors and insurance agents, whether you're independent or with a broker dealer - we can help!

Will this work with my compliance department?

Yes! This is a compliance friendly solution for all compliance departments. If you have stricter than normal compliance regulations, we will communicate directly with your compliance to make any amendments to your campaign before launch.

How does your pricing structure work?

At Apex Acquisition, we do things differently. We don't do "pay per lead" or "pay per appointment" because that business model is fundamentally flawed. Companies that use this model get paid based on how many leads you buy, and not whether that lead actually shows up, is qualified or becomes a client - the incentives are off. Our goal isn't to flood you with leads but to only get you in front of the people that you want to be speaking with.

How long does it take to see appointments on my calendar?

Say goodbye to month-long setup times. We'll have your campaign ready within 7-10 days and within 24-72 hours of going live, you are likely to see your first appointment scheduled.

What type of show up rate and close rate can we expect?

On average we are seeing a 70% show up rate and 25-50% close rate off the appointments that you speak with. Appointments that don't show up, are not counted towards our guarantee.

Who do you serve?

We help financial advisors and insurance agents, whether you're independent or with a broker dealer - we can help!